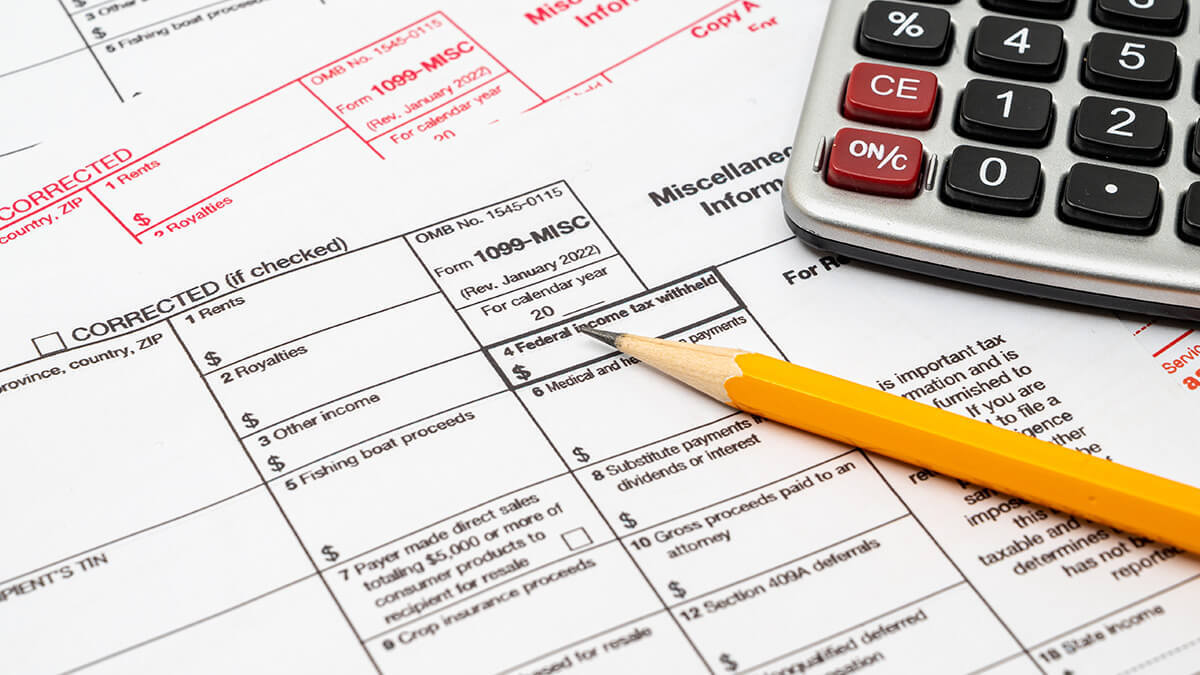

1099 Deductions List 2025. There are a number of business deductions you can take as an independent contractor, including health insurance, home office deductions, mileage and deductions for. There are 22 different versions of form 1099, each for various types of income like dividends, interest, royalties, rents, and other investment income.

1099 Tax Deductions List 2025 Lesly, In this guide, we will cover what 1099 deductions for contractors are, pros, cons, who qualifies, and how to write off expenses.

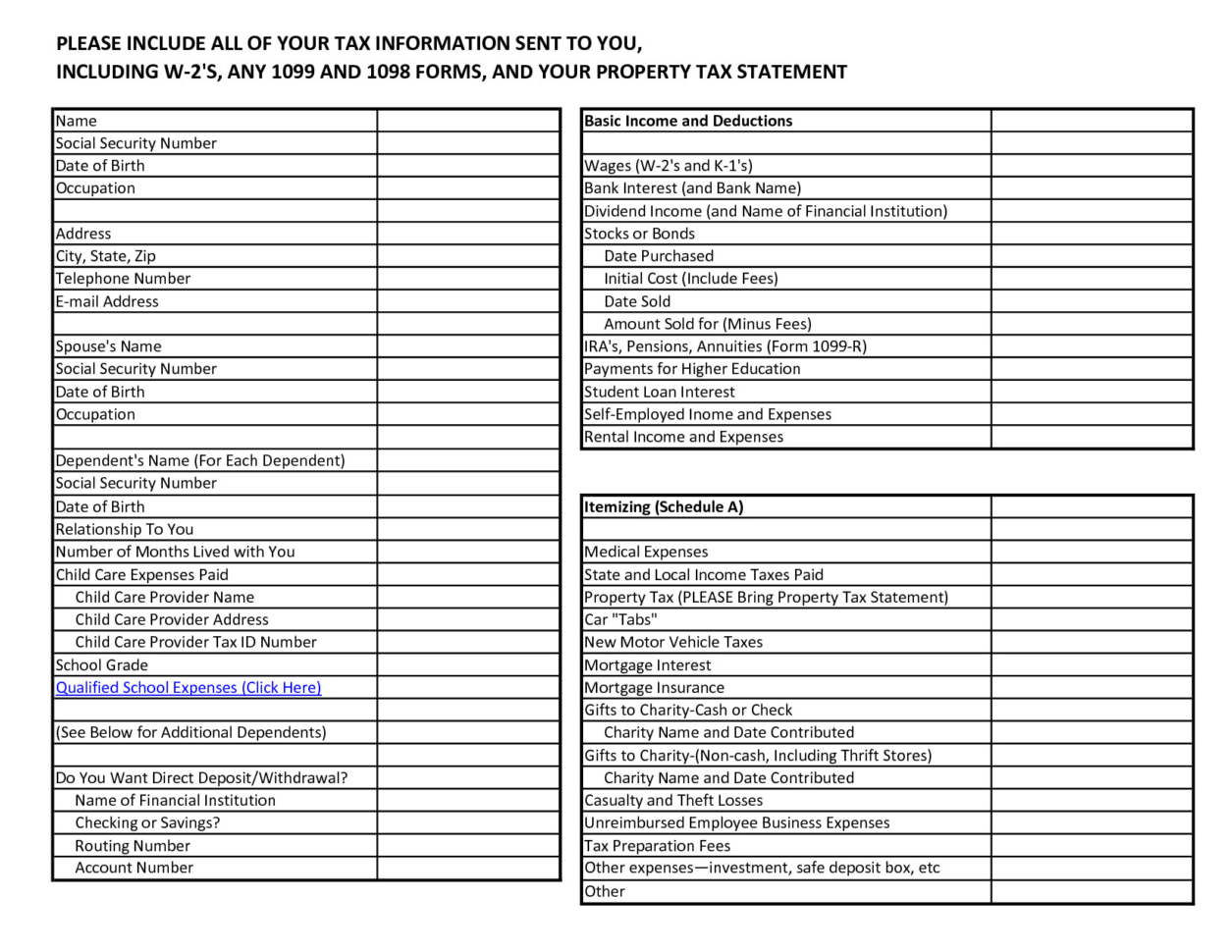

1099 Tax Deductions List 2025 Lesly, Knowing which deductions you can legitimately claim for your occupation is also an important step to getting the tax refund you deserve, and following a comprehensive checklist is an easy way.

InDepth 2025 Guide to 1099 MISC Instructions BoomTax, In this guide, we will cover what 1099 deductions for contractors are, pros, cons, who qualifies, and how to write off expenses.

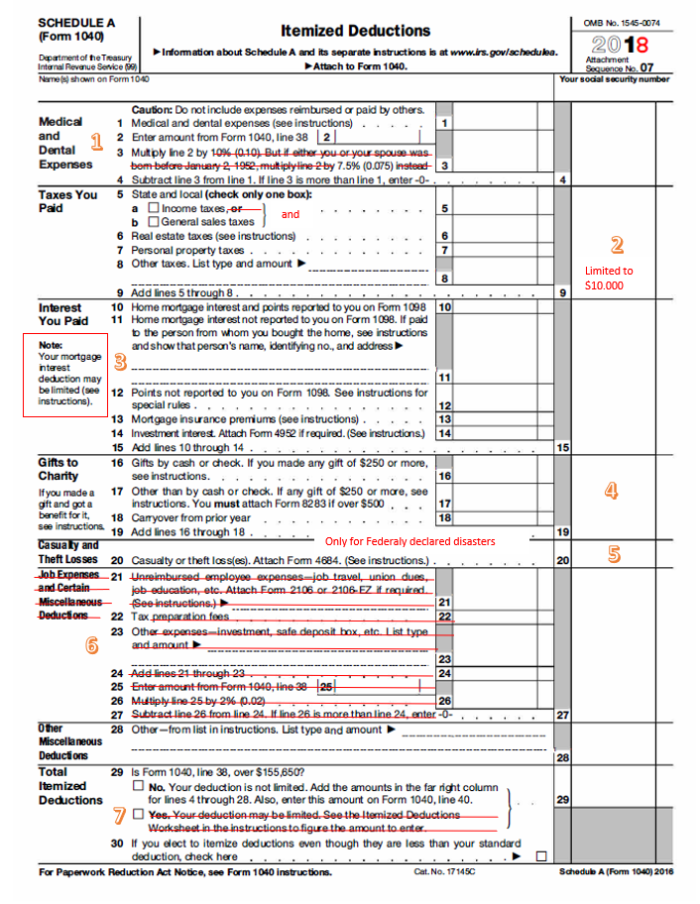

Itemized Deductions List 2025 Joice Rebeka, 1099 contractors don't have federal income tax withheld on the.

Single Deduction 2025 Magda Roselle, Some office supplies are common no matter what kind of work you do.

Parttime contractor? How to track your 1099 expenses, There are 22 different versions of form 1099, each for various types of income like dividends, interest, royalties, rents, and other investment income.

Everything You Should Know About 1099 Deductions Amazing Viral News, Uncover more about these unique tax deductions below.

1099 Form Tax Deductions Form Resume Examples qeYzkbRV8X, For the 2025 tax year, the irs is using a $5,000 threshold, regardless of the number of transactions.

1099 deductions What is Included? by FlyFin AI Medium, Uncover more about these unique tax deductions below.

Tax Deductions for the 1099 Physician, Knowing which deductions you can legitimately claim for your occupation is also an important step to getting the tax refund you deserve, and following a comprehensive checklist is an easy way.